January 28, 2011

US Manufacturing Output is Up, But What About Jobs?

From the Mercatus Center at George Mason University:

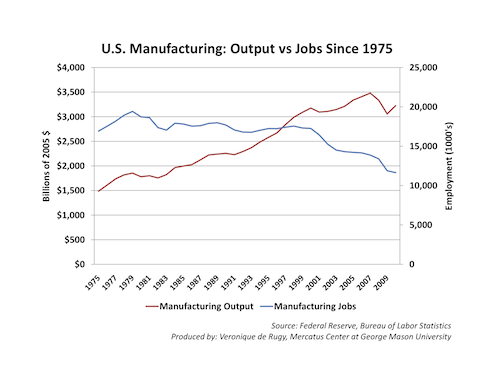

Since 1975, manufacturing output has more than doubled, while employment in the sector has decreased by 31%. While these American job losses are indeed sobering, they are not an indication of declining U.S. competitiveness. In fact, these statistics reveal that the average American manufacturer is over three times more productive today than they were in 1975 – a sure sign of economic progress.In a piece critical of President Obama's corporate tax policies, Veronique de Rugy explains that U.S. companies are at a disadvantage to their foreign competitors because they are taxed more--and often twice--for the same production:The true cause of dwindling American competitiveness is a tax code that puts domestic firms at a clear disadvantage – not a lack of skill or innovation on the part of the American worker. (Chart after the jump).

The U.S. corporate tax rate is simply too high. When you add state corporate taxes to the 35 percent federal rate, you arrive at a whopping 40 percent average corporate tax burden, the second highest among the 30 countries in the Organization for Economic Cooperation and Development (OECD)....Not only is the U.S. rate too high, but the U.S. government also taxes corporations on their worldwide income. That means profits made by an American-owned computer plant are subject to U.S. tax whether the plant is located in Texas or Ireland....One way companies avoid these penalties is to become foreign-owned. De Rugy:Imagine a French firm competing with a U.S. firm for business in Ireland. The Irish government taxes each subsidiary on its Irish income at the (low) national rate of 10 percent. Fair enough. But unlike the French competitor, the U.S. parent company must also register its Irish affiliate’s dividends back home as income, which is then taxed. If the company can meet certain requirements, it can receive a credit for taxes paid to the Irish treasury. But the firm would still have to pay American taxes at the American rate on the Irish income minus the tax credit. The result is double taxation, costly paperwork, and less competitiveness than the French.

....Because of higher tax costs, U.S.-based firms are losing foreign market share, generating lower returns for American shareholders, and hiring fewer skilled workers back home in the United States. Under these conditions, it’s no surprise that American multinational companies that want to sell their goods abroad try to keep as much cash out of the U.S. as they legally can. It’s a matter of survival.

This is called corporate inversion: A company switches to the flag of a lower-tax jurisdiction. Such transactions generally have little real effect on U.S. business operations. Firms still pay taxes on all U.S. income, but they no longer pays U.S. tax on foreign income. Companies that can’t afford the costs of inverting probably would have to reduce operations and/or fire workers.It's a global marketplace and other countries have taken steps--including massive corporate subsidization (Airbus)--to ensure they have leg up on their competition. We need to ensure that American companies can compete for their own sake and for the sake of their employees.Corporate inversions are just one of many ways in which a U.S. firm can end up being owned by a foreign parent company. A forward-looking American startup may decide to incorporate abroad to enjoy long-term tax savings. That means fewer new jobs in the United States. Foreign acquisitions of U.S. companies have soared from $91 billion in 1997 to $340 billion by 2007.

Although I did not see it,I have several times heard of a segment of "Modern Miracles" shown on the Discovery Channel. This segment showed a Hyundai (or Kia) plant in Alabama.The plant is so roboticized that it chiefly employed 62 "technicians". Their job was to mind the machines which produced the cars.

GM tried to attempt this in the 70's and 80's, unions with the aid of the government stymied this.

While tax policy is one of the factors which do not aid manufacturing, it is one of many.

Those old enough to remember the 70's may recall the constant drumbeat to get rid of those "Smokestack Industries". Well, we did.

The Congress spent years beating on the auto industry, secure in the knowledge that Toyota would save them.

So as you sow, so shall you reap.

Posted by: Warrington Faust at January 29, 2011 11:54 AMI noted a story in the news today that a nail manufacturer in Mansfield, MA is expanding. What they produce is the flat, or "cut", nails used in antique houses. They are the last American nail company.

This may appear to be "niche marketing", but I see it otherwise. It is an admission that we cannot compete in the broader market, that is perhaps a million times larger. So, we have withdrawn into a "cottage industry" in a market so small that, for the moment, no one would bother to compete.

Posted by: Warrington Faust at January 29, 2011 12:00 PMDon't worry, "knowledge economy" jobs will save us here in Rhode Island, along with legalizing gay marriage and importing more illegal alien workers into the state. Governor Chafee said so, and he never lies.

I can still recall ten years ago, when one of my instructors at J&W would go on and on about how so many IT jobs were going to be created in the 2000s, "there won't be enough workers to fill them all!" Several of my unemployed and semi-employed friends that earned IT degrees find that story quite amusing now.

Posted by: Chris at January 29, 2011 1:20 PM1)'Invest' in high speed rail

2)?????

3)Win the Future!!! (aka WTF)

Or not.

Posted by: chuckR at January 29, 2011 6:25 PM"1)'Invest' in high speed rail"

If that was economically viable, private industry would be all over it. It is often forgotten that our freight rail system is the envy of the world.

With all the talk of "high speed rail" I have often wondered why we don't move to monorail. The government already owns a right of way, known as Route 95. Surely that would be cheaper than tearing up and replacing all of that road bed.

You right wing A holes don't get it- the Great Leader has said all we need to do is print more money and "invest" more in the poor, underfed public employee unions.

Posted by: Tommy Cranston at January 29, 2011 7:13 PM