Recoveries: The Difference the Debt Makes (Not to Mention the Government’s Focus)

Earlier today, Glenn Reynolds linked to an American Enterprise Institute post by James Pethokoukis, drawing on charts from economist John Taylor showing that the United States economy hasn’t been returning toward where it would have been without the crash, and that this is unusual for prior downturns.

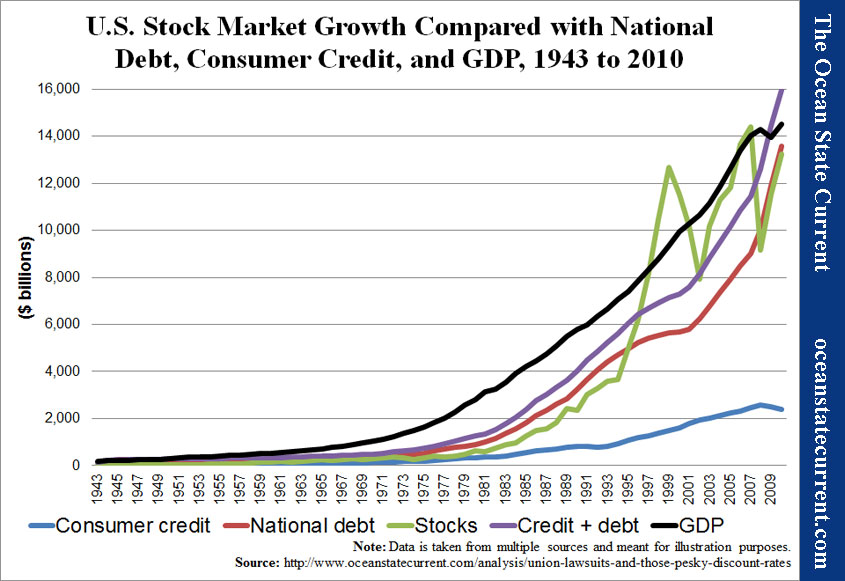

The reasons, I think, can be inferred from this chart, which I created with a view toward answering the question of whether it’s reasonable to continue expecting 7-8% returns on pension fund investments:

Continue reading on the Ocean State Current…

Add a few more lines and a couple of colorful “data” points and you might pass this off for a Jackson Pollack.

Have you been tapping his pill bottles?