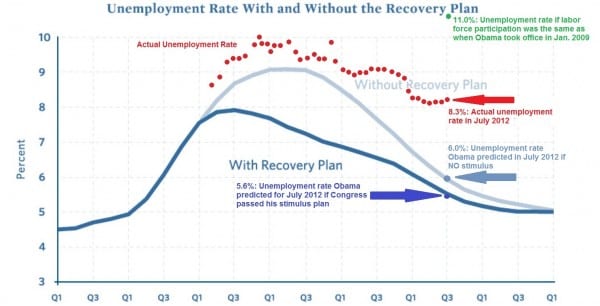

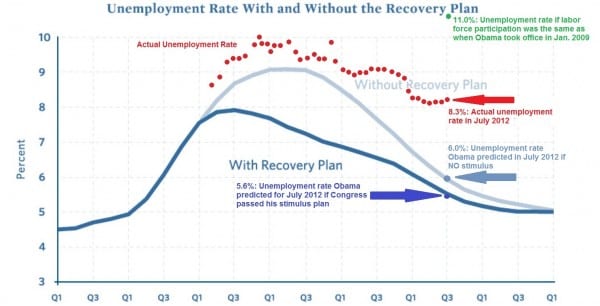

One Graph Says it All

Hm. So what this says is we’d have been better off without the stimulus?

Well, at least we’re in our 3rd “recovery summer“, ’cause one just wasn’t enough!

ADDENDUM: Woops, almost forgot. It’s Bush’s fault.

Hm. So what this says is we’d have been better off without the stimulus?

Well, at least we’re in our 3rd “recovery summer“, ’cause one just wasn’t enough!

ADDENDUM: Woops, almost forgot. It’s Bush’s fault.

Marc – Apparently you didn’t get the memo. The Keynesian economists and central planners in the Obama Administration were unable to accurately predict the full extent of the crisis in 2009 because they were not provided with sufficient information from the Bush administration and bankers on Wall Street. That is why their predictions fell short, and it is therefore not *fair* to hold them accountable. Rather than admitting the futility of making such forecasts in the first place, they have since revised their numbers, which they assure you are now 100% totally reliable and accurate.

Dan,

You caused quite a stir on the dark side.

Max – Thank you for your support in that forum, although I did nothing but offer commentary. I was sorry to learn that only certain commentary is acceptable in progressive circles. It seems that the more editors change over there, the more they stay the same.

“Woops, almost forgot. It’s Bush’s fault.”

Damn straight.

Now, if Mitt Romney is elected in November and things don’t go well, will we be able to claim that it’s Obama’s fault three years into a Romney presidency?

I think there is little surprise here. Despite all the talk that the sainted Mr. Roosevelt “led us out of the Depression”, later economists find this not to have been the case. Government programs may have even extended it.

Shocking! The law of unintended consequences rears it’s ugly head again while the populace looks to self absorbed incompetents like Hussein to lead them straight over the cliff.

Given the nature of the financial disaster that caused this, I don’t think there was a way for the government to reduce the damage very much. One way or another, lots of people would be left either walking away from or paying-down years’ worth of negative equity.

I just think it would have been more disastrous for anyone in government or the Fed to tell the truth. Can you imagine the stock market after this announcement, or trying to get elected on it:

“I think it’s pretty clear that 8+% unemployment is the new normal until this $3 trillion of negative equity gets paid down, which will take five to ten years. That’s what you get when you live high on a bubble for over a decade. In the meantime, expect 1% annual growth and stagnant wages, we’ll do what we can to keep interest low so the economy doesn’t just die outright.”