How many weeks do you have to work?

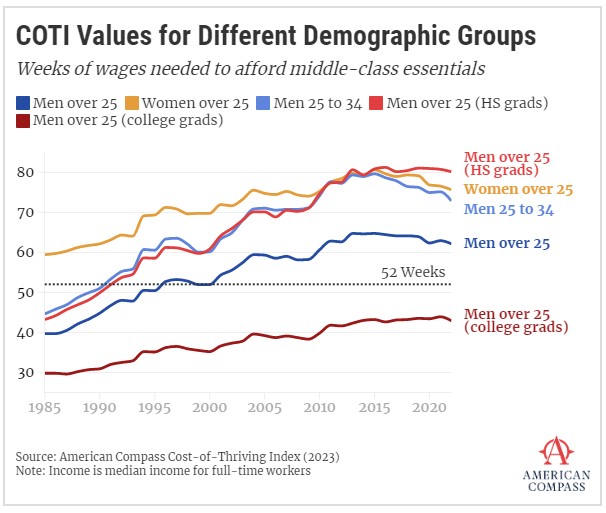

Oren Cass’s analysis of the weeks required to support a middle-class lifestyle for American Compass raises some interesting points. The study focuses on the income of men and shows that the combined cost of food, housing, health care, transportation, and education surpassed the median male income in the mid-’90s. By 2022, that income was about 20% shy of the mark. Americans have to work more weeks than there are in a year to cover a year’s expenses.

Given the focus on male stagnation, one might expect Republicans to be particularly sensitive to this problem in the midst of culture wars, but the emphasis goes the other way. Among Democrats, 41% “strongly agree” the shortfall is a big problem, whereas only 25% of Republicans say the same. The interesting aspect of this finding, though, is the factors that might account for it. For one thing, a chart of the number of necessary work weeks by state suggests that, generally, Republicans are more likely to live in states where the inability to afford essentials is genuinely less of a problem, whereas Democrats are more likely to live in states where it’s a massive problem.

If that answer is a bit too technical for your tastes, consider also that the question was part of a broader survey, so the order of the questions may primed both Republicans and Democrats to see the question in terms of welfare rather than work. Evidence for this proposition can be found in a chart asking, “Is Economic Pressure to Have Two Working Parents a Big Problem?” Republicans were more likely than Democrats to answer “big problem,” even though it’s arguably another way of asking the same question.

This chart, which is the only one to bring women into the picture, illustrates another interesting finding:

The key point of which we shouldn’t lose sight is that only male college graduates still make enough money to support a family. (Data for female college grads isn’t shown, so we can’t compare.) The three other lines for men — high school grads, those aged 25-34, and the average for those over 25 — were able to make ends meet in the ’80s but no longer can.

Because they’ve lost ground less quickly, the average for all women over 25 caught up with that for male high school grads and early-career men about a decade ago. Since then, the male high school grads have seen no improvement, while the average for women has more or less tracked with early-career men in making up some of the lost ground.

We aren’t given the data for women who are only high school grads, but the fact that women now outnumber men by big percentages in college makes it likely they’re faring better than their male peers. We also have to account for the fact that the discrepancies of the past are still with us. That is, the overall average for men and women remains skewed by the way things were 30 or 40 years ago.

This particular dataset is insufficient to justify broad proclamations, but we’re on safe ground to offer that America has problems that need quick reactions.

Featured image by Adraien Van De Venne.

I have to wonder. Just as student loans allowed the universities to seemingly raise tuition to any point desired, did working wives (two income families) allow costs to rise in the sense it was possible to meet those costs?