The problem with user fees (for RI) is that direct and comprehensible spending thwarts grift.

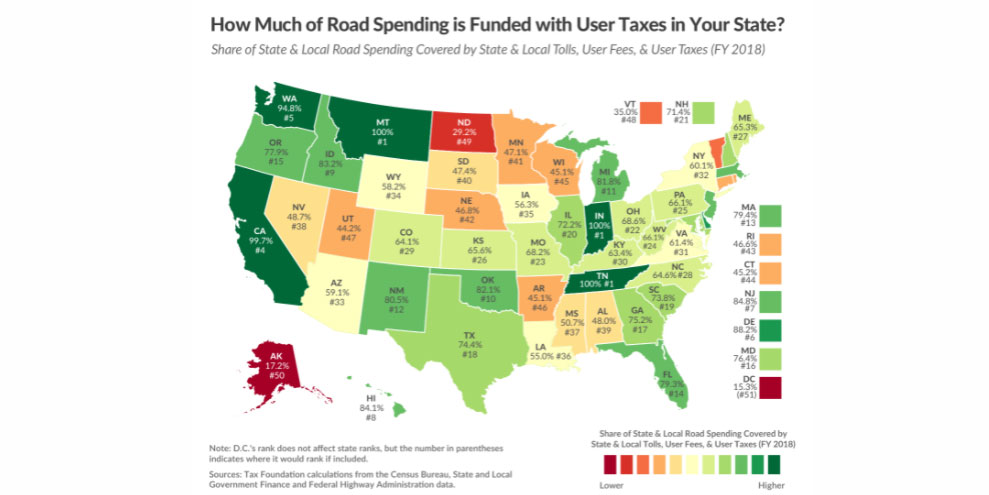

How about a fun, wonky post? The featured image that you see is a Tax Foundation map ranking states by the percentage of their infrastructure spending that is funded by user fees. In the Tax Foundation’s views, higher user fees are preferable:

Both the federal government and the states raise revenue for infrastructure spending through taxes on motor fuel and vehicles. The states also collect fees from toll roads and other road charges. This system constitutes a well-designed user fee system, as taxes paid by users of infrastructure are dedicated to building and maintaining infrastructure. However, neither the federal government nor the vast majority of states collect enough taxes through these levies to cover infrastructure-related spending.

Under this philosophy, Rhode Island is seventh worst.

Of course, intrepid progressive Rhode Island politicians like then-governor and now-U.S.-commerce-secretary Gina Raimondo see this as an opportunity. Around these parts, user fees are the thing government imposes when the tax burden is getting intolerably high, but they still want more money. Local bags for trash collection are a great example of this.

It’s just a way to make people feel like they’re merely paying for a service when the reality is that they’re already paying for it by other means.