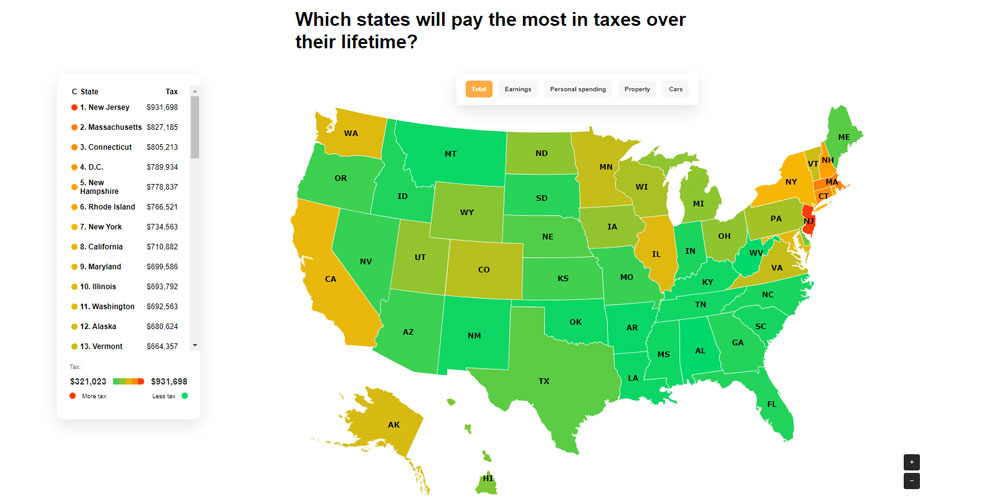

What would you do with another $766,521 in retirement if Rhode Island didn’t confiscate it?

That is the amount that Brad Polumbo reports through the Foundation for Economic Education as the lifetime tax bite that makes Rhode Island sixth worst in the country. Polumbo’s source is a report titled “Life of Tax: What Americans Will Pay in Taxes Over a Lifetime.” The average for the country overall is $525,037, meaning that Rhode Islanders are taxed nearly 50% more over their lifetimes. Would anybody claim that we can see the benefit in the services our state and local governments manage to offer in exchange for all that cash?

Here’s how the total breaks down for Rhode Island by category:

- Taxes on earnings: $442,931 (12th worst)

- Taxes on personal spending: $32,655 (17th worst)

- Taxes on property: $226,110 (4th worst)

- Taxes on cars: $64,826 (3rd worst)

Breaking the numbers out this way allows some straightforward analysis. That lifetime tax on cars is the equivalent of two nice family cars or up to four functional budget cars, depending on your tastes and your needs. The tax on property is equivalent to a working-class house — as a primary residence, vacation home, or rental.

The U.S. Census currently puts Rhode Island’s median household income at $67,167, suggesting that your whole household works nearly seven years to cover the cut government takes directly from your earnings, which just happens to be the high end of a contract for indentured servitude in North America. Thus, the lifetime cost of government in Rhode Island is a house, three cars, and seven years of your household’s labor, or 47% of your lifetime earnings.