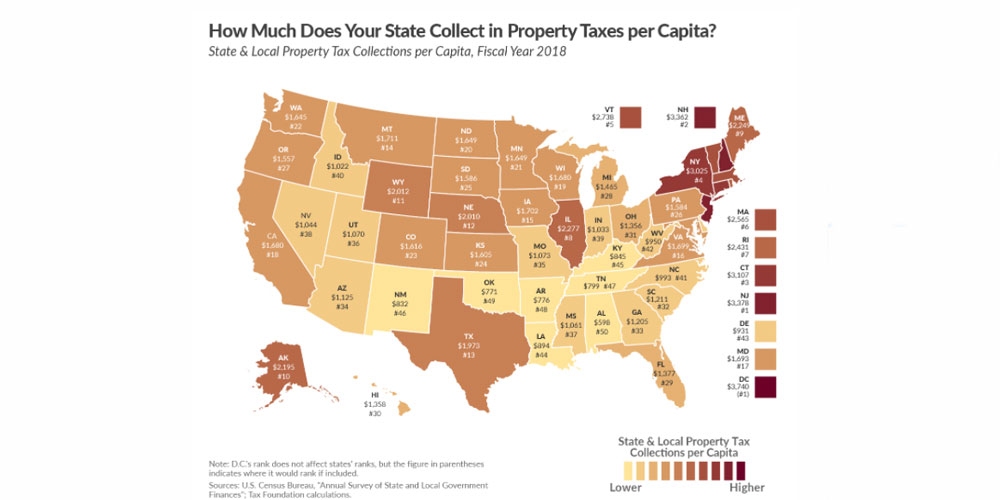

Rhode Island’s per Capita Property Taxes are 7th Highest in the U.S.

According to the Tax Foundation’s relevant tax map, government entities in Rhode Island collect the equivalent of $2,431 from every man, woman, and child in the state in property taxes. Of course, many of those men, women, and children live on the same property (and some have more than one), so the per family amount is much higher.

One problem with the property tax is that it goes directly to the price of the house you can afford. With most people buying their houses with mortgages and building tax payments into their mortgage payments, this increase is direct, indeed. High property taxes can also have the perverse effect of shifting more of the tax burden onto lower-income residents, as the effect of the taxes is higher on more-expensive homes, suppressing their value and thus shifting the weight of a town’s valuation away from the high end.

On the other hand, taxing property is a relatively even and straightforward way to collect taxes. It also tends to shift emphasis to local government. Paying more in property taxes and less in other, typically statewide, taxes so that government activities are handled closer to the taxpayer and voter is arguably a worthwhile tradeoff. Note that New Hampshire is number 2 on the Tax Foundation’s map (at $3,362) and not very far from number 1 New Jersey (at $3,378).

Property taxes also distort the economy less than sales taxes and are less invasive than income taxes.

The conservative response to this map, therefore, could reasonably be that it’s only more evidence that other taxes in Rhode Island should be reduced.

[…] This is reflected in Rhode Island’s overall income tax burden, which ranks near the middle of the pack. It is important to note that our overall tax burden is eighth highest – undoubtedly exacerbated by high property taxes. […]