I’ve got no special feelings for Washington Trust, but I don’t trust the plaintiff.

Yesterday, through the ministrations of U.S. District Attorney Zachary Cunha under Attorney General Merrick Garland, the Biden administration pressured Rhode Island’s Washington Trust bank into a multimillion-dollar settlement and imposed a big PR hit over alleged racism in its lending practices. Journalists are faithfully transcribing the “redlining” narrative they’ve been handed, which means our state is not having the important discussions needed on this topic. The racist lending is supposedly “proven” through statistics and disparate outcomes based on race and neighborhood, but nobody seems interested in details.

To my eye, the key detail is the banks the Biden Administration considers to be “peer lenders,” which are supposedly less racist than Washington Trust. As far as I can tell from the settlement, “peer” is defined as receiving no fewer than half Washington Trust’s number of home mortgage loan applications and no more than twice that number. That sounds like regional banks, but presumably, it could also include niche lenders specifically serving minority neighborhoods or the small online lenders that seem to proliferate.

In other words, a few online banks somewhere in the country could be lifting the average to a degree a specific brick-and-mortar bank in Rhode Island shouldn’t be expected to achieve, all things considered. A serious study (and a serious judicial investigation) would provide a table of all of the “peer lenders,” not just compare one bank to the group average. If there are just a handful of banks in the pool, and if some are focused on serving this particular community, then it’s possible that a majority of the “peers” could be just as “racist” as Washington Trust, but when grouped with a few with very high percentages of lending in these neighborhoods, the average goes up.

If this is the case, then the district attorney could investigate other banks, and Washington Trust would be among the “peer lenders” group with a better average. With millions of dollars and deep, sensitive social divisions on the line, basing accusations on statistical outcomes, we should expect a more substantive analysis than might be required for a project in an undergrad course. Along similar lines, notice that in all the detailed maps in the DA’s exhibits, not a single one shows detail from another bank. It is as if the prosecutors know that nobody is ever going to demand that it actually prove a case.

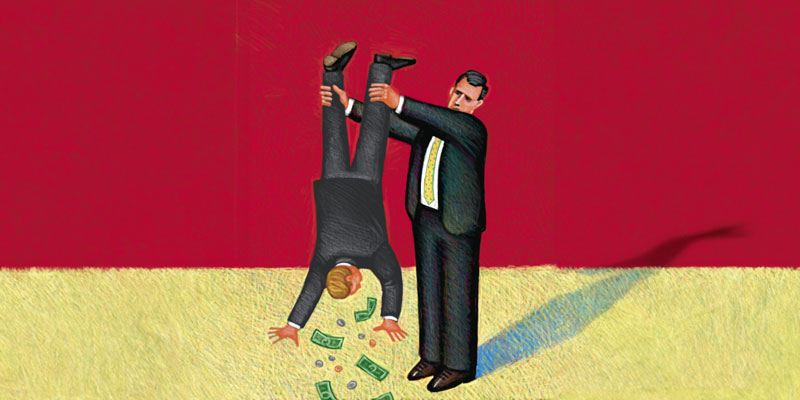

Unfortunately, our local news media is unlikely to pursue a narrative (which I’d bet is the truth) in which a local Rhode Island institution is being shaken down by a cynical Democrat administration looking for political talking points to shore up one of its key dependent constituencies.

Even more, none of this touches the broader question of whether every bank needs to solicit applications from minority areas. The existence of peer lenders that are receiving the applications suggests that residents are able to find lenders, and I’ve seen no argument that mortgages from Washington Trust are especially beneficial. Social and economic costs are associated with the federal government’s shaking down American businesses in order to foster racial grievance headlines, and we should be having a public debate whether the benefits (if there are any) are worth it.

Featured image modified from Shutterstock.

The Racist Issue is Out of Control, it not being acknowledged that everywhere Black’s are Out if Control, they are more the Problem then not!

I’m sitting here watching the news, the KY AG is being interviewed, also discussing all of the Smash and Grab goings-on around the Country! He happens to be Black…he just stayed that if America continues to nor acknowledge that Black’s are a Big Part of the Problem…America is in a lot of trouble!

FINALLY!!!!!

[…] ought to be disqualifying for him to continue holding his position. I’ve offered my opinion on the Biden Administration’s shake-down operation for financial institutions, but the point […]

[…] Conversations related to the Washington Trust settlement with the government, requiring the bank to address alleged racial discrimination on its part, indicate two views or standards for handling blame in society. […]