As Americans on both sides of the political aisle highlight how poorly situated our federal government is in a time of international volatility (albeit for different reasons), we can’t look only at events of the past few months. We also can’t assume we know the full answer fully from our own perspectives, so this is just my brief summary.

Certainly, the seeds of the present fell into Western Civilization’s soil centuries ago, but tracing the many interweaving vines from those events isn’t directly helpful for any practical action. So, the broadest I’ll go is to blame a century and a half of progressives’ impatience with the gradual advancement of society coupled with conservatives’ inattentiveness to preventing them from undermining the core of our key institutions.

That jointly culpable broad trend culminated, after the outrageous treatment of President George W. Bush, in detrimental inflection points during the Obama presidency, which transformed what should have been a morally historic milestone — election of the first black President — into perhaps the pivot point at which the end of our country became inevitable. Many examples are available, but a few of the principal ones are:

- Obama’s general tone of Alinskyite division

- The government’s overreaches and subversion of precedent and due process for such innovations as Obamacare and the housing bubble bailouts

- The Supreme Court’s redefinition of marriage as the culmination of a social campaign by cultural elites, especially inasmuch as it involved simply devaluing and ignoring contrary arguments, supported by…

- Progressives’ growing comfort with using psychological strategies to “nudge” masses of people toward “decisions” that the powerful people preferred (for everybody’s own good, naturally)

- The Obama administration’s shuffling of billions of dollars of borrowed federal money to radical activists and intellectuals by various projects, funding streams, and requirements

Not only did each of these factors have its own directly deleterious consequences, but together they set the stage for the backlash election of President Donald Trump, after which progressives and Democrats (if they aren’t precisely the same group) amplified their divisiveness and self-permission to ignore established process and civic etiquette, and even (I’d say) to undermine our democratic standards in order to cheat.

That state of affairs — which could be the result of natural forces and human nature or a to-some-degree deliberate campaign by communist revolutionaries — has brought us to what might be the end stages of collapse or, at least, a civil war.

Featured image created by Justin Katz using Dall-E 3 on ChatGPT.

[Open full post]I ask because that looks pretty clearly to be what happens in the video attached to this tweet:

Given some online interactions, I’m not even sure Democrat partisans are psychologically capable of seeing the kick — as if it’s one of those optical illusions that some people just don’t process. I suppose the best-case scenario (if I suffer from an opposite shortcoming) is that the frail White House occupant tripped on the dog like he recently tripped on a stage, but that’s a problem in its own right.

Of most fundamental concern, however, is the need for a single standard. We all know how this video would be treated were Biden a Republican. In that way, this minor matter is too perfectly representative of so much about Biden’s time in office. Powerful forces are set on ensuring he is propped up and his disasters are spun to be positives. If this video does catch some attention, expect Democrats to crow about how agile he must be to kick a big dog like that.

[Open full post]For reasons of prudence and compassion, we should be reluctant to judge the parenting decisions of others. Most often, we don’t know the individuals or their challenges well enough to interject our views. On the other side of the ledger, however, radicals leverage this interpersonal etiquette to establish detrimental norms — to which others’ response is verboten — that serve their political ends. And so, to an extent, we’re obligated to respond when public figures make public statements about their parenting decisions when they can’t help but affect cultural norms.

Here’s local media personality and meteorologist Kelly Bates allowing her family matters to become a politicized part of her conversation with Lauren Clem of Rhode Island Monthly magazine:

You mentioned earlier that your daughter, Winter, came out as transgender in 2021. What has it been like supporting and mentoring her knowing that she’ll face unique challenges as a trans woman?

It’s tough. But I was well prepared from my father. My father always instilled, ‘Family is everything.’ The mindset that if anyone in your family needs you, you’re there. It doesn’t matter, you drop everything and you run. His family that he grew up with was the same way. It’s all about family. So I was prepared. She came out — ‘Yes, absolutely, no problem. Whatever your needs are, they will be met, 100 percent.’ And that’s my dad. Winter initially came out as gay in high school and then went to college on Prince Edward Island for the first two years through the Berklee extension program, and it was during the second year that she was up there that I got a text one day that said, ‘Um, I’m a girl.’ And I said, ‘I always wanted a daughter,’ which is true. And off we went.

For the sake of clarity, we must clarify (insofar as clarity is even possible, these days) that the person Bates calls her “daughter” is a biological male who was previously her “son.” And I clarify further that I offer this in the spirit of a hopefully helpful participant in the public discussion among parents about the best approaches to raising healthy, well-adjusted children in a maniacal era.

To be blunt, I cannot think of a worse response to a son who announces that he is a girl than, “I always wanted a daughter.” As a moody and creative adolescent, I had my bouts of suicidal ideation, and it seems to me (having struggled my way through that morass) that a parent’s telling a confused son that she always wanted a daughter is tantamount to a parent’s telling a suicidal teen that, truth be told, a childless household, or a home with one with fewer children, had always been the preference. In the latter case, the parent would confirm to the child that he or she never should have been born, and in the former, that the parent never really accepted or desired the child as he or she was.

I sincerely hope for the most-life-affirming outcome possible for the Bates family. In the specific case of this interview, I hope (almost suspect) that Kelly’s statements are a sort of performative progressivism that isn’t truly representative of the situation. But for anybody facing similar questions, I find it my moral responsibility to suggest that she got it wrong. Some parents will hope (and, yes, pray) for a reversal of declarations such as her child’s, but in any event, disclaiming the identity that a child had professed up until that tentative “um” reversal is utterly irresponsible. Parents should want sons as much as they should want daughters. What they should want, at the core of it all, is the children whom they have.

I don’t doubt for a moment Kelly Bates would agree with this imperative, stated as such, but I fear, in the delusional hysteria of the trans movement, the affirmation of whims has overwhelmed true acceptance, which, as a parent, must incorporate guidance toward accepting reality. Indeed, fundamental to parenting inchoate humans is the establishment of the principle that reality exists, which is the polar opposite to confessing that one has always wished the reality of the child had been different.

Featured image created by Justin Katz, processing the text of “Antigonish” by Hughes Mearns through DALL-E.

[Open full post]Visit the page for this video on the Ocean State Current.

[Open full post]I mentioned to Mike Stenhouse on an episode of In the Dugout that will air soon that the danger of mail ballots may only be resolved when powerful people begin to worry that they won’t be better at it than their opposition. That’s why it’s important to increase awareness of videos like this, from Connecticut:

I think you’d have to be crazy to think this isn’t happening around the country, wherever mail ballot voting is too easy. And to those who insist that there’s “no evidence of widespread fraud,” I can only say you’re missing the point.

Outright “illegal ballot” fraud is the final margin applied to broader levels, from systemic suppression of news and bribery of constituents to constantly changing rules and arduous campaign regulations to ordinary ballot harvesting. All those layers, though, are why I’m skeptical this will be fixed. The powerful own too many layers.

[Open full post]Remember when then-Governor Gina Raimondo (a Democrat, if that needs saying) insisted we needed truck tolls to fund her RhodeWorks program to finally fix the state’s infrastructure? Well…

As with the state’s pension system — which the state went right back to reamortizing as soon as Raimondo left her treasurer role — she’s a master of setting up solutions for which she won’t be around to be accountable.

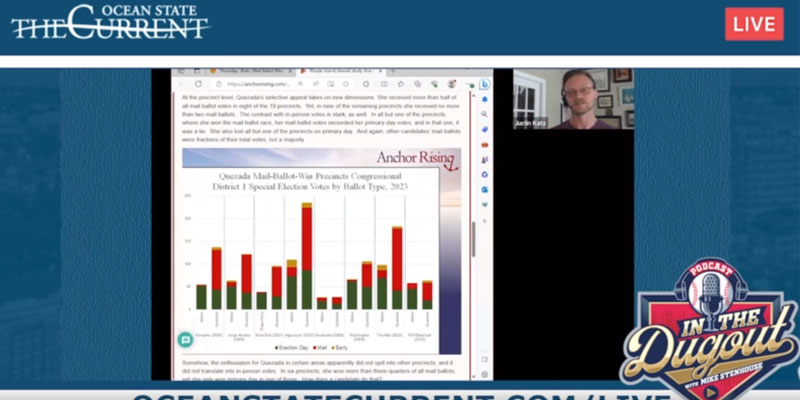

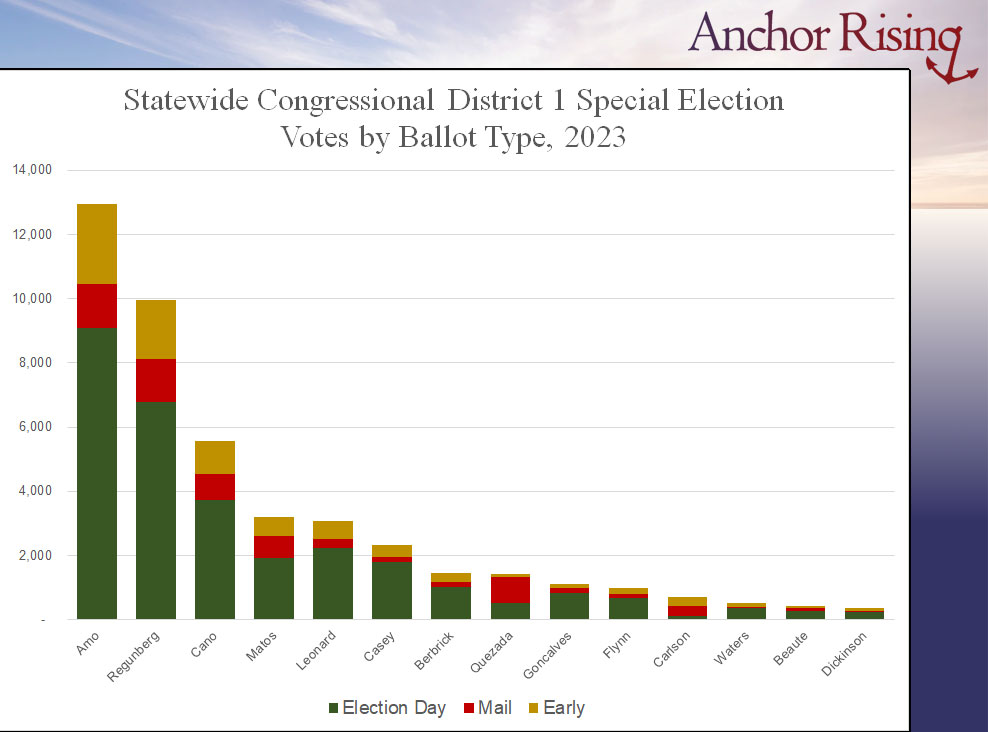

[Open full post]Originally published September 10, 2023. Update added charts.

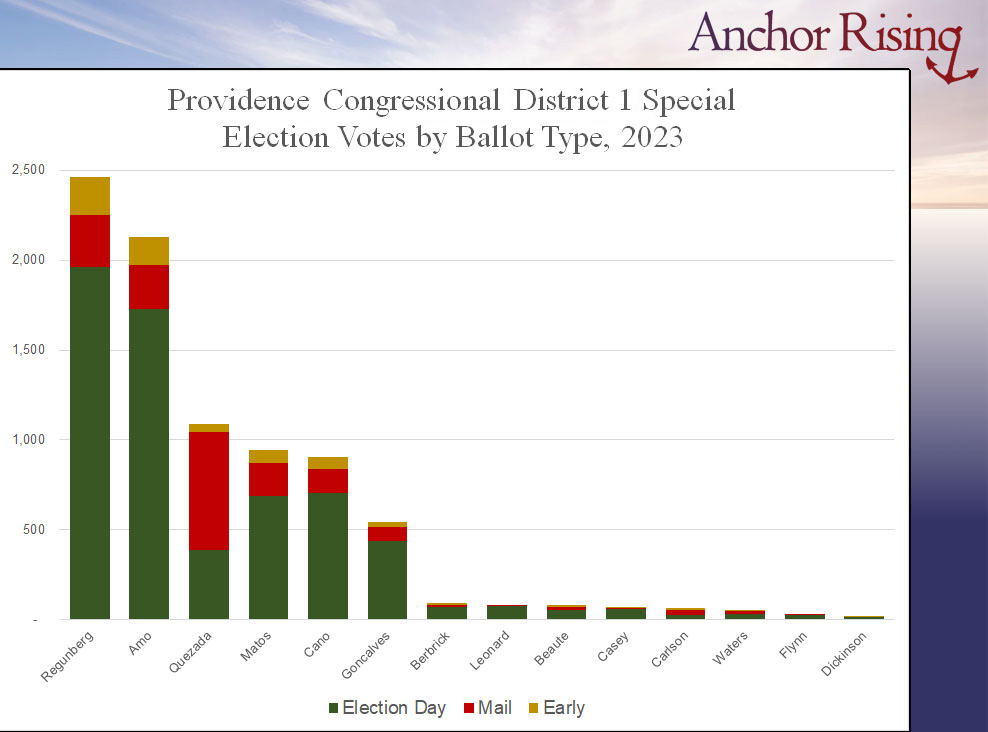

Of all 14 candidates from both parties running in Rhode Island’s special Congressional race for district 1, Democrat state Senator Ana Quezada of Providence received the eighth most votes. She received the 10th most votes on primary day itself, and the 12th most early votes. But on the mail-ballot front, she excelled, coming in third.

That’s quite a showing, and the difference between her mail ballot votes and in-person votes is stunning. Her appeal, let’s say, is surprisingly selective. With the peculiar exception of Donald Carlson, who dropped out of the race shortly before primary day, she’s the only candidate to receive more mail ballot votes than primary-day votes. Not including Quezada and Carlson, the average candidate’s mail ballot votes amounted to just 13% of the candidate’s total votes. For Quezada, it was 57%.

Zooming in on the results, Quezada’s feat becomes even more impressive. In Providence, Quezada came in third place overall on the strength of her top number of mail ballots. She received more mail ballot votes than the top two contenders — Gabriel Amo and Aaron Regunberg — combined. Adding Sandra Cano’s mail ballots to their total just barely overcomes Quezada’s advantage.

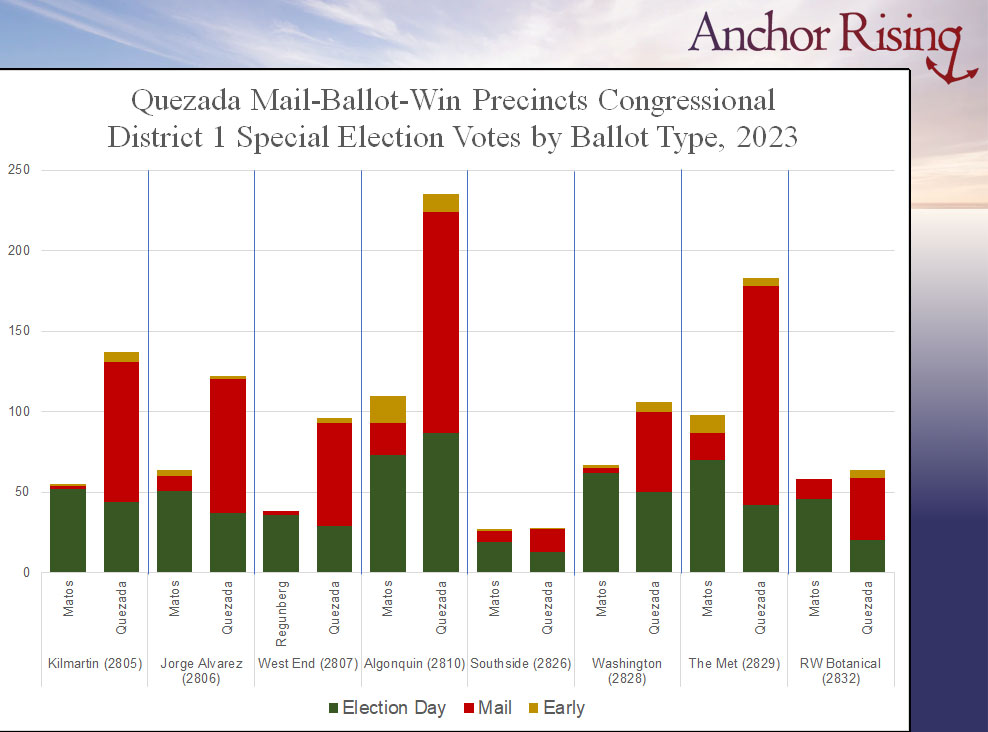

At the precinct level, Quezada’s selective appeal takes on new dimensions. She received more than half of all mail ballot votes in eight of the 19 precincts. Yet, in nine of the remaining precincts she received no more than two mail ballots. The contrast with in-person votes is stark, as well. In all but one of the precincts where she won the mail ballot race, her mail ballot votes exceeded her primary-day votes, and in that one, it was a tie. She also lost all but one of the precincts on primary day. And again, other candidates’ mail ballots were fractions of their total votes, not a majority.

Somehow, the enthusiasm for Quezada in certain areas apparently did not spill into other precincts, and it did not translate into in-person votes. In six precincts, she won more than three-quarters of all mail ballots, yet she only won primary day in one of those. How does a candidate do that?

Two possibilities present themselves: plain fraud or ballot harvesting. Thanks to recent changes, no witnesses or notaries are required to be named on mail ballots, so the only name interested Rhode Islanders can check appears if somebody else picks up the ballot for a voter (and the security of that system is not something on which I can comment). On that list, the state has Lazaro Quezada — which is Ana’s husband’s name — picking up 86 mail ballots in the districts in which Ana strongly dominated and 105 total, which is four times more than the next most-prolific collectors. A Miguel Quezada picked up another nine. Most voters sent in or delivered a request form, and there is no record of any help they may have received doing that.

This raises an important question: Given these peculiar results, can the Board of Elections, Secretary of State, and Attorney General even investigate if they wanted to? In some precincts, Quezada received all but a handful of mail ballot votes, so contacting the voters could shed some light, but that’s quite a bit of labor when a simple requirement for witness signatures could make such ballots much more secure. Even if Quezada’s mail ballot efforts are totally straightforward and legal, Rhode Islanders should ask themselves if a campaign of picking up, delivering, and turning in ballots will ensure the representative democracy they want.

Be that as it may, Rhode Islanders should make a point of learning Quezada’s secret, either to justify necessary mail ballot reform or to compete. We can be sure special interests are mastering the game. Indeed, given her limited local reach, it could be that Quezada has merely offered us a warning of what other candidates are already doing, but with more calculation and subtlety.

Featured image by Shutterstock.

[Open full post]Underdog sports team hires a beautiful and pop star with a surprising soft side to pretend to date one of its players to boost its ratings, and they wind up falling in love.

On WNRI 1380 AM/95.1 FM, John DePetro and Justin Katz discuss:

- The RIGOP and Leonard’s expectation that campaign attention just happens

- Magaziner gets in shots as the D-mob’s nerdy guy

- Neronha slips and slides in the X-Twitter mudpit

- A BOE retirement shows the people serve the government

- Ana Quezada’s retirement deal sets her up in the machine

- The PILOT light too low in Providence

Featured image by Justin Katz using Firefly.

I mean, what’s the point?

Not only has Secretary of State Gregg Amore already publicly proclaimed Amo the winner, but by the time of this debate it’s likely more than 30% of all ballots will already have been cast.

Let’s cut to the chase. Instead of an election, Rhode Island might as well have a sort of electoral college whereby the people who harvest mail ballots each gets a proportional vote in the outcome. It’d be more honest.

[Open full post]